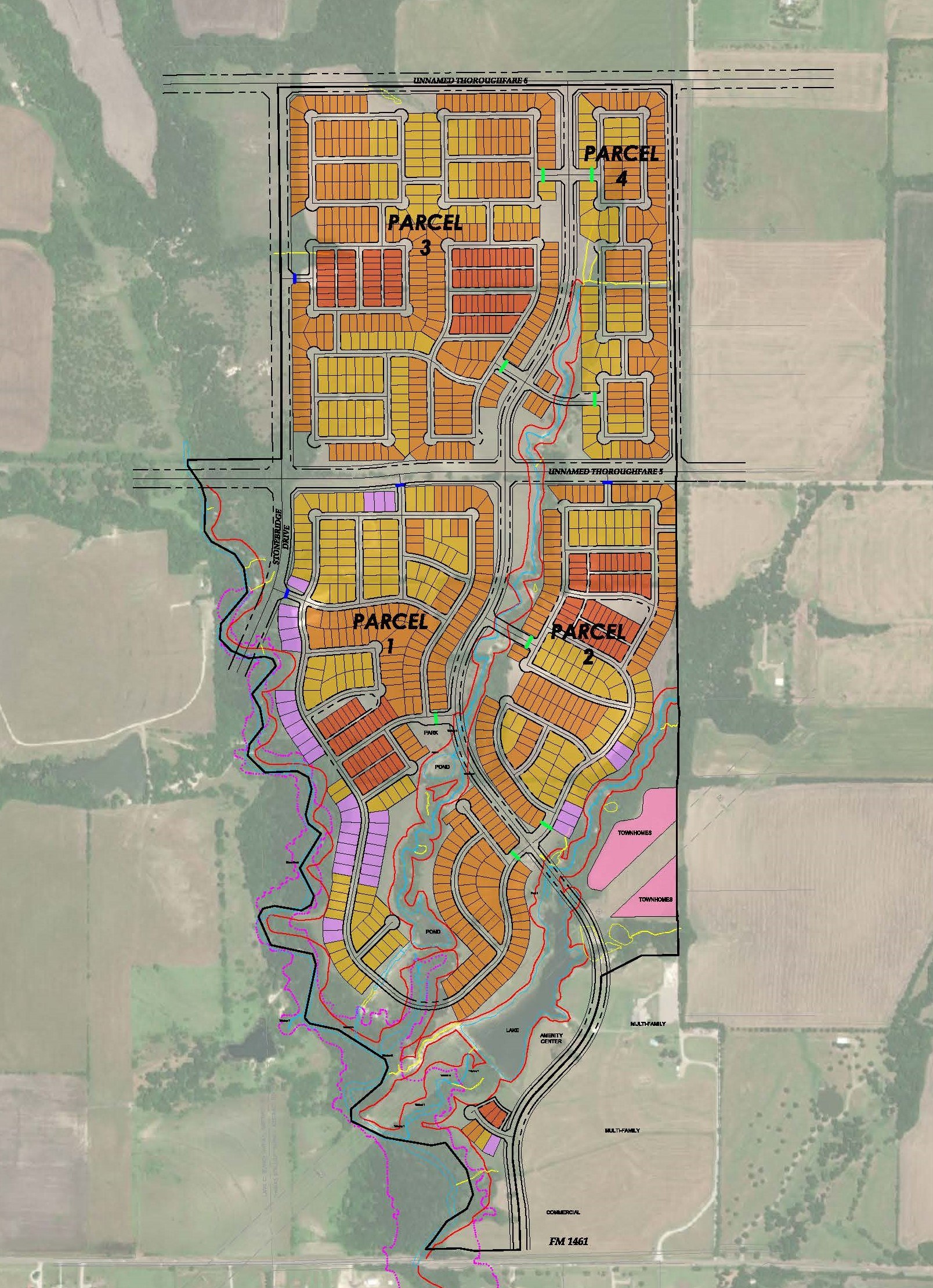

(MCKINNEY, TEXAS) – Hines, the international real estate firm, along with Trez Capital, a leading non-bank commercial mortgage lender in North America, today announced plans for a new 414-acre, gated community offering luxury single-family homes in McKinney, Texas, a growing submarket of Dallas.

This new community will consist of over 1,100 home sites ranging from 40- to 70-foot wide offering a variety of designs and floorplans from multiple homebuilders including M/I Homes, Highland Homes, Toll Brothers, Shaddock Homes and William Ryan Homes. The community will offer residents high-end amenities including private gated entrances, a state-of-the-art clubhouse, a resort-style pool and a private, extensive trail system.

Aster Park will offer residents modern, luxurious homes with a quiet, suburban ambiance. As an added benefit to Aster Park residents, the community is located in the Prosper ISD school district, one of the best in the Dallas metro. McKinney also recently ranked as the 4th fastest growing city in the United States and provides easy access to downtown Dallas with the anticipated new additions to the Dallas North Tollway.

“We are seeing a shift in the residential market as more people seek larger homes to accommodate the desire to work from home while fostering a greater sense of community with their neighbors,” said Dustin Davidson, managing director at Hines. “We are excited to work closely with Trez Capital and bring Aster Park to market to offer residents a new luxury community where they can live, work and play.”

Hines has over 64 years of development experience in Texas and has nearly two decades of experience developing single-family communities. Since 2005, 20 communities and over 10,000 lots have been completed to date with over 20,000 additional lots currently under development in 26 different communities across our Southwest region.

“Demand for single-family homes continues to dominate the residential real estate market, and Hines’ Aster Park development will provide a dynamic option for families seeking a live-work-play lifestyle that’s abundant with modern amenities.” said Jennifer Fisher, vice president at Western Alliance Bank. “We are strongly familiar with both the residential real estate market in the Dallas-Fort Worth area, as well as with Hines’ commitment to developing exceptional communities. Western Alliance supports the forward-looking vision for Aster Park, and we are privileged to provide strategic financing solutions to help bring it to life.”

Construction on new Aster Park homes is expected to begin in 2022 and sales are expected to begin in 2023.

About Hines

Hines is a privately owned global real estate investment firm founded in 1957 with a presence in 255 cities in 27 countries. Hines oversees investment assets under management totaling approximately $83.6 billion¹. In addition, Hines provides third-party property-level services to more than 367 properties totaling 138.3 million square feet. Historically, Hines has developed, redeveloped or acquired approximately 1,486 properties, totaling over 492 million square feet. The firm currently has more than 171 developments underway around the world. With extensive experience in investments across the risk spectrum and all property types, and a foundational commitment to ESG, Hines is one of the largest and most-respected real estate organizations in the world. Visit www.hines.com for more information. ¹Includes both the global Hines organization as well as RIA AUM as of June 30, 2021.

About Trez Capital

Founded in 1997, Trez Capital is a diversified real estate investment firm and preeminent provider of commercial real estate debt financing solutions in Canada and the United States. Trez Capital offers private and institutional investors strategies to invest in a variety of opportunistic, fully secured, mortgage investment funds, syndication and joint-ventures and provides property developers and owners with quick approvals on flexible short- to mid-term financing.

With offices across North America, Trez Corporate Group has over $3.9* billion CAD in assets under management and has funded over 1,600 transactions totaling more than $13.5 billion CAD since inception. For more information, visit www.trezcapital.com. (*Trez Corporate Group AUM includes assets held by all Trez related entities as well as $2.7 billion Manager AUM (Trez Capital Fund Management Limited Partnership)).