A diversified, research-driven Asia-Pacific core-plus fund targeting strong risk-adjusted returns through strategic asset selection and asset management1.

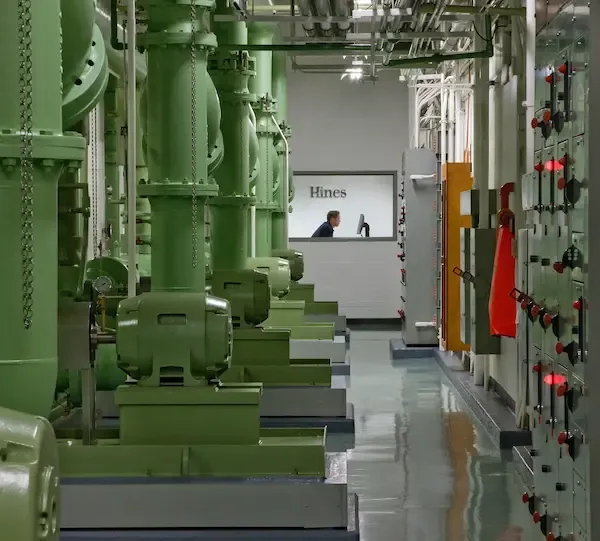

Hines Asia Property Partners ("HAPP" or the "Fund") is an open-ended fund that invests across developed Asia markets and sectors, leveraging on Hines' research insights and local market expertise to optimize performance.

Talk to the HAPP Team

Contact Us