A diversified, research-driven European Core Plus fund delivering strong risk-adjusted returns through strategic asset selection and active management1.

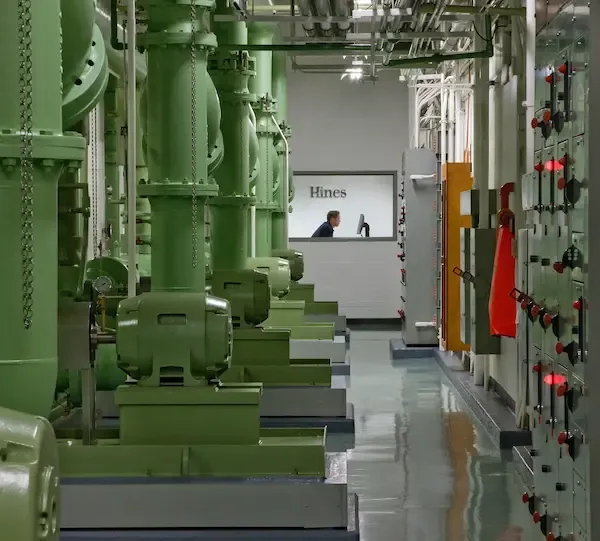

Hines European Property Partners (“HEPP” or the “Fund”) invests in good quality, substantially stabilized assets across key European markets with embedded growth potential. The Fund seeks to increase value by leveraging Hines’ proprietary research and on-the-ground platform to increase value.

Talk to the HEPP Team

Contact Us